The Texas Instruments (TXN) deal to buy National Semiconductor (NSM) for $6.5 billion adds fuel to what’s become a hot market for mergers and acquisitions in the tech sector.

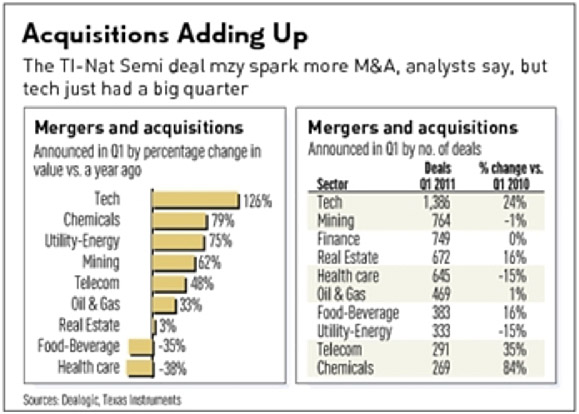

The dollar value on tech M&A deals worldwide hit $47.3 billion in the first quarter, up 126% from Q1 2010. The second-hottest sector, chemicals, rose 79% to $50.6 billion, according to industry tracker Dealogic. The tech sector also had the most deals, 1,386, up 24%.

“M&A activity is clearly heating up, though more on larger deals than in the midsize market,” said Andrew Greenberg, CEO of research firm GF Data Resources.

He says the focus has been on larger deals for two reasons. For one, the larger companies’ business performance has been steadier and easier for buyers and sellers to track. But also key is that banks are more confident in larger buyers and are more willing to fund bigger deals.

“Banks remain somewhat cautious after the last recession, but they are healthier and want to put their money to work,” Greenberg said.

In terms of total dollar volume, telecom M&As led in Q1 at $94.4 billion, up 48% from a year ago, according to Dealogic. That was driven by AT&T’s (T) $39 billion bid for T-Mobile USA, the largest M&A deal announced last quarter and the largest telecom deal since 2006.

M&A activity has risen steadily since the dark early days of the recession and shows no sign of weakening.

“Going back to the first quarter of 2009, we’ve seen a steady increase in the number of deals every quarter,” said Joseph Steger, who heads the technology segment of Ernst & Young’s Transaction Advisory Services. In 2010, E&Y says the total value of tech deals worldwide rose 26% from 2009. And the number of deals jumped 41%.

Companies see consolidation as a way to boost revenue and expand their business opportunities, Steger says.

Industries Maturing

“A large number of players are in mature sectors,” he said. “Combining companies gets them a better cost structure and new channels and opportunities to sell product.”

The agreement by Texas Instruments to buy National Semi fits that pattern. It will expand TI’s breadth in sales of analog chips, increase its product mix at the high end of the market and enhance cross-selling opportunities, Michael McConnell, an analyst with Pacific Crest Securities, wrote in a research report.

That deal could kick off a wave of chip industry M&As in 2011, Caris & Co. analyst Craig Ellis told IBD.

Many large tech companies are in a good position to handle big acquisitions because they’ve been stockpiling cash.

The top 25 technology firms ended the year with about $528 billion in cash and equivalents, up 23% from $429 billion at the end of 2009, Steger says.

“As the economy improves, and the stock market too, we’ll continue to see an uptick in deals,” Steger said.

China Seen Boosting M&As

M&As are on the rise globally as well. Looking at the value of deals announced in 2010, 41% involved cross-border deals, up from 25% in 2009.

Analysts expect China to get more involved. Historically, most China acquisitions have been domestic, accounting for two-thirds of deals in that country last year.

But many China companies are cash-rich and have access to credit, Steger points out.

“Longer term, we expect to see China be more aggressive in cross-border deals,” he said. “They want to be a global leader in technology.”

One example is the acquisition of California-based Riot Games by China-based Tencent Holdings in February for $400 million.

The M&A activity among smaller companies, though, could remain tepid, says GF Data’s Greenberg. GF Data focuses on tracking midsize and smaller M&As.

“First-quarter activity (ended up) a little below the industry average,” Greenberg said. “It’s taking these companies longer to reload than people might think.”