A question raised with increasing frequency this past year is: Are valuations of middle market businesses becoming commoditized? That is, if you have a business of a given size and industry, is it more likely now than at some point in the past to be valued within a narrower and more easily predicted range, often expressed as multiples of cash flow?

To begin by pulling the rabbit out of the hat, I believe that the answer is no – but that sophisticated deal practitioners need to continue to adapt in response to the market forces that give the question such currency.

These market forces include:

(1) Proliferation of business information

In our world, this trend has been exemplified by BizEquity, a firm that that takes data from many sources and feeds it into an algorithm that generates a view of value. BizEquity’s principals stress that their product is a tool and not a substitute for professional judgment, but it is nevertheless an example of how much information is commonly available.

(2) Reduced use of discounted cash flow analysis

While financial buyers still generally model return expectations based on projected company performance and capital structure assumptions, over the past 15 years discounted cash flow analysis has become less prevalent in shaping expectations on the sell-side — perhaps because DCF calculations based on owner-provided data and assumptions often result in the over-valuation of small private firms. While multiples themselves are certainly vulnerable to selective use, they clearly have become more of the norm.

(3) Greater influence of debt providers in driving equity values

As discussed in my September comment “Confluence of Debt,” it is hard to recall a market in which equity values have been driven by debt values to the extent that is the case now, at least on transactions with financial buyers. If a lender provides an early debt read of 4.5 times EBITDA with a minimum equity commitment of 40 percent, the implied valuation floor of 7.5 times is likely to be more influential than any other data point in shaping initial expectations.

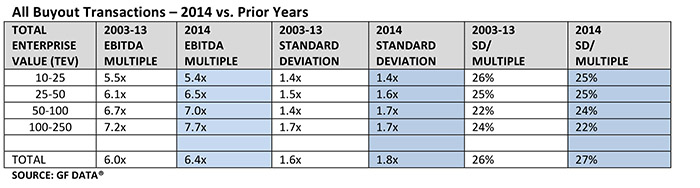

GF Data’s window on this question is the nearly 2,000 transactions in our universe – deals completed since 2003 by financial buyers in the $10 million to $250 million Total Enterprise Value (TEV) Range. If valuations are commoditizing, it stands to reason that we would be seeing declines in standard deviation on pricing multiples (see footnote 1).

In fact, standard deviations are not declining. We looked at 1,625 buyouts in our data base. For the first nine months of 2014, standard deviations as percentages of TEV/Adjusted EBITDA multiples were almost exactly in line with historic numbers. See table below:

Some other interesting trends:

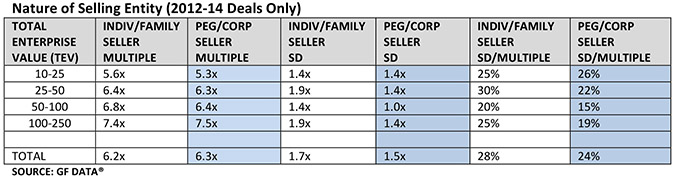

- At every valuation level except the smallest, there is markedly greater dispersion in values among businesses sold by individuals or families, as opposed to those in private equity or corporate hands prior to sale. (Our data contributors have been characterizing the sellers only since 2012).

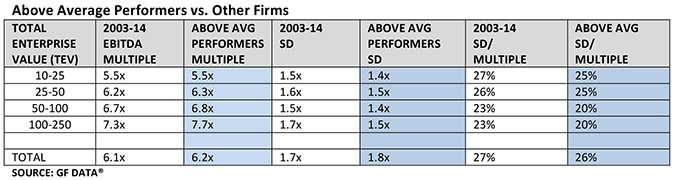

- Firms with above-average financial characteristics (see footnote 2) historically are valued with less dispersion than other businesses – and the larger the size grouping within our universe, the tighter the trading range.

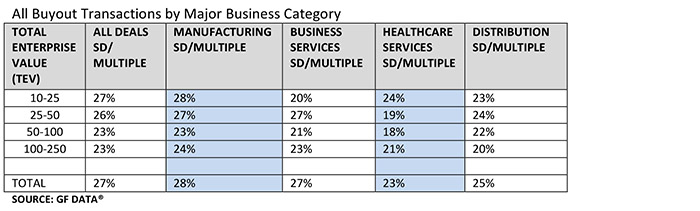

- There are some variations in standard deviation among business categories. Whether these are “differences that make a difference” is another question.

So what can we conclude?

1. The data does not suggest that valuations are commoditizing.

2. The individualized circumstances and subjective judgment of would-be buyers remain as much in force as ever in driving varying views of value.

3. The factors that tend to lead to premium pricing in pricing – size, financial quality, caliber of prior management — tend to be recognized similarly across multiple transactions. Thus, selling businesses offering these characteristics are on average valued within narrower ranges. (This does not contradict the general impression that all other things being equal, a larger business is more likely than a smaller one to attract outlying valuations because there are more components to value to be assessed by different buyers.)

4. Finally, this analysis seems to jibe with many conversations we’ve had with deal professionals and buyers around the country. Not all would-be sellers are the stereotypical data-miners with exaggerated views of value. There are more and more who take advantage of the wealth of information available – and perhaps prior transaction experience – to arrive at a realistic sense of what their business is worth. For these business owners, the favorable outlier may be elusive as ever, but their sense of a likely trading range can be enough of a basis for proceeding to market without the felt need for a full-scale auction.

***

This article first appeared in Private Equity Professional Digest www.pepdigest.com and may not be reprinted or used without written permission from GF Data® or Private Equity Professional Digest.

***

Andy Greenberg is CEO of GF Data and Managing Director of Fairmount Partners, an M&A firm. Both are based in West Conshohocken, PA. He received the 2014 Alliance of M&A Advisors (AM&AA) Middle Market Thought Leader of the Year Award.

Andy Greenberg is CEO of GF Data and Managing Director of Fairmount Partners, an M&A firm. Both are based in West Conshohocken, PA. He received the 2014 Alliance of M&A Advisors (AM&AA) Middle Market Thought Leader of the Year Award.

GF Data Resources provides data on private equity sponsored M&A transactions with enterprise values of $10 million to $250 million, offering private equity firms and other users external information to use in valuing and assessing M&A transactions. GF Data collects transaction information from private equity groups on a blind and confidential basis. Data contributors and paid subscribers receive two products ‐‐ high‐level valuation and leverage data via electronically delivered quarterly reports, and continuous access through the firm’s web site to detailed valuation data organized by NAICS industry code. For information on subscribing to GF Data or to contribute data as a private equity participant, contact Bob Wegbreit at bw@gfdataresources.com or visit the firm’s website at www.gfdataresources.com.

____________________________________________________________

Footnotes:

1. Quick statistics refresher: one standard deviation encompasses 68 percent of the data points in a normal bellshaped distribution. While our entire data set is close to a normal distribution, small samples are more likely to be skewed. So, if the average multiple for a data set is 6.5x and the standard deviation is 1.5x, the appropriate inference is that approximately 68 percent of the data points fall between 5.0x and 8.0x. We use standard deviation as a percentage of EBITDA multiple herein as a way of standardizing the data.

2. GF Data defines sellers with above-average financial characteristics as those with Trailing Twelve Month Revenue Growth and EBITDA margins both in excess of 10%, or one in excess of 12% and the other at least 8%.

© 2015 PEPD • Private Equity’s Leading News Magazine • 1-30-15

“GF Data is one of the only data sources that can provide our clients with valuation data specific to the size of their business from the perspective of financial buyers.”

—Jeremy Ellis, Genesis Capital

“GF Data reports on what financial buyers are really paying for middle market companies. They also provide valuable data on leverage, pricing, and terms and conditions. There is no other reliable source for this type of data.”

—Ronald Miller, President and Managing Director, Cleary Gull Inc.

“As the leading underwriter of public capital in the BDC sector, we rely on GF Data to give us a competitive edge and keep us current on leverage and valuation levels.”

—Joe Culley, Head of Capital Markets, Janney Montgomery Scott

Contact Info:

GF Data Resources LLC

2176 Harts Lane

Conshohocken, PA 19428

610-616-4607

info@gfdata.com

News

Registered Subscribers

Subscription Renewal

New Subscription Request